AgentOps helps developers see inside their AI agents by logging every prompt, action, and cost. This review explains how it works, its features, setup, and why it’s becoming the go-to debugging tool for AI developers.

How to Build Credit as a New User and Avoid Costly Financial Mistakes!

Building credit as a new user can feel like planting a garden from scratch. According to Experian, there are several ways to start nurturing your credit, including becoming an authorized user on someone else's credit card, applying for a secured credit card, or using a credit-building debit card. Like tending to young plants, these methods require patience and consistent care to help your credit score grow over time.

Understanding Credit - The Basics

usaaef.org

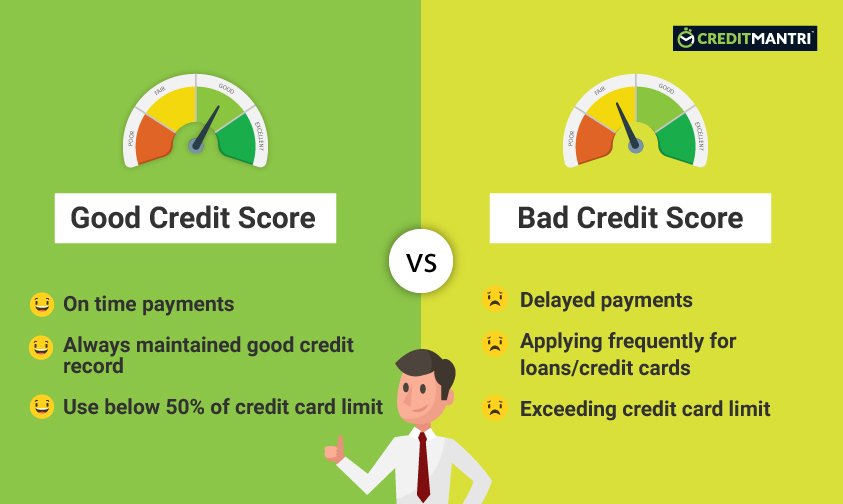

Think of your credit score as your financial GPA. Just like in school, where your grades show how well you're doing academically, your credit score shows how well you're managing your money. This score typically ranges from 300 to 850, and just like with grades, the higher, the better 1. Now, let's break down what goes into this financial GPA:

- Payment History (35%): This is like your attendance record. Are you showing up on time to pay your bills? It's the most important factor, so paying bills on time is crucial.

- Credit Utilization (30%): Imagine you have a water bottle. Credit utilization is like how full your bottle is. Lenders prefer to see it less than half full. So, if you have a $1,000 credit limit, try to use less than $300.

- Length of Credit History (15%): This is like your seniority in school. The longer you've had credit accounts open, the better. It shows you're experienced in handling credit.

- Types of Credit (10%): Think of this as having a diverse extracurricular portfolio. Having different types of credit (like credit cards, loans, etc.) shows you can handle various financial responsibilities.

- New Inquiries (10%): This is like how many new classes you're signing up for. Too many new credit applications in a short time can make lenders nervous, just like taking on too many new subjects at once might worry your teachers.

Now, how do you check your financial report card? That's where credit reports come in. These are detailed records of your credit history, maintained by three major credit bureaus: Experian, Equifax, and TransUnion. Think of these bureaus as different teachers, each keeping their own gradebook on your financial behavior 3.

The good news is, you can check your credit report for free! It's like being able to see your report card anytime you want. You can do this at AnnualCreditReport.com 4. In fact, you can now get free weekly online reports from all three bureaus through this website 3.

Just like you'd want to correct a mistake on your report card, it's important to check your credit report for errors. Mistakes happen, and they can unfairly lower your credit score. If you spot an error, dispute it immediately. It's like going to the teacher to correct a grading mistake – it's your right and responsibility to ensure your record is accurate 4.

Remember, building good credit is a marathon, not a sprint. It takes time and consistent good habits, but with patience and responsible financial behavior, you can achieve an excellent credit score.

Initial Steps to Build Credit as a New User

self.inc

Building credit as a new user is like learning to ride a bike with training wheels. You start small, build confidence, and gradually progress to more advanced techniques. Let's break down the steps to get you rolling on your credit journey.

3.1. Start with a Credit Account

Think of your first credit account as your training wheels. Here are three popular options:

Secured Credit Card: This is like a bike with extra-sturdy training wheels. You put down a refundable deposit (usually $200 or more) which becomes your credit limit 1. It's perfect for beginners because it reports to credit bureaus, helping you establish credit history 2.

Become an Authorized User: This is like riding a tandem bike with someone who already knows how to ride. A trusted friend or family member with good credit adds you to their credit card account. You benefit from their positive payment history without the responsibility of making payments 3. Just make sure they have good credit habits, or you might both fall off!

Student or Starter Credit Card: These are like bikes designed specifically for beginners. They often have low credit limits, no annual fees, and come with educational resources1. If you have proof of income, you're more likely to be approved.

3.2. Use Credit Responsibly

Now that you're on your bike, it's time to pedal responsibly:

Make Small Purchases and Pay in Full: Start with small, manageable rides. Use your card for minor expenses you can easily afford to pay off each month 4. Set Up Automatic Payments: This is like having a helmet for your credit. It prevents late payments, which can significantly harm your score 4.

Keep Credit Utilization Low: Imagine your credit limit as a bike lane. Try to stay in the first third of that lane. If your credit limit is $500, aim to keep your balance below $150 4.

3.3. Diversify Credit Usage Over Time

As you get more comfortable, you can try different types of "bikes":

- Credit-Builder Loan: This is like a stationary bike for credit. You make payments into a savings account, building a positive payment history.

- Mix Different Types of Credit: Eventually, you'll want to ride different types of bikes. Having both revolving credit (credit cards) and installment loans (personal loans, auto loans) can boost your score.

- Avoid Opening Too Many Accounts at Once: Don't try to ride too many bikes at once! Each credit application triggers a hard inquiry, which can temporarily lower your score.

3.4. Monitor and Maintain Your Credit

Regular maintenance keeps your bike (and credit) in top shape: Check Your Credit Report Regularly: This is like inspecting your bike for issues. Look for errors, fraud, or suspicious activity 4. Dispute Any Errors on Your Credit Report: If you find a problem, fix it! Contact the credit bureau if you spot incorrect information 4.

Keep Old Accounts Open: Your old bike might not be flashy, but it shows you've been riding for a while. Similarly, keeping old accounts open maintains the length of your credit history 4. Remember, building credit is a journey, not a race. Start slow, be consistent, and before you know it, you'll be cruising down the financial highway with confidence!

Common Mistakes New Credit Users Make

cio.com

Building credit is like tending a garden - it requires care, attention, and avoiding common pitfalls. Let's explore some credit-damaging weeds you'll want to pull out of your financial garden:

4.1. Missing Payments or Paying Late

Think of your payment history as the main crop in your credit garden. Even one missed payment can be like a hungry rabbit munching away at your hard work. A single late payment can dramatically lower your credit scores, especially if you have good or excellent credit 1. These pesky late payments can stick around on your credit report for up to seven years, like stubborn weeds that just won't go away 2.

To keep your credit garden thriving, set up automatic payments - it's like installing an automatic sprinkler system for your bills. If you think you might miss a payment, reach out to your lender before it happens. They might be willing to work with you, like a friendly neighbor offering to water your plants while you're away1.

4.2. Maxing Out Credit Limits

Maxing out your credit limits is like overwatering your plants - it drowns your credit score. Your credit utilization rate, or how much of your available credit you're using, is a crucial factor in your credit score. It's like the soil moisture level in your garden - you want it just right, not too high or too low.

Aim to keep your credit usage below 30% of your available credit 3. For example, if your credit limit is $1,000, try not to use more than $300. The closer you get to that 30% mark, the more rapidly your scores will decrease, like wilting plants in oversaturated soil 3.

4.3. Applying for Too Many Credit Accounts

Applying for multiple credit accounts in a short time is like planting too many seeds at once - it can overwhelm your garden. Each credit application typically results in a hard inquiry on your credit report, which can lower your score by a few points 4.

Too many applications in a short period can make you look financially unstable to lenders, like a gardener frantically planting everything in sight. Instead, choose your credit applications carefully, like selecting the right plants for your garden's conditions 4.

4.4. Ignoring Your Credit Report

Neglecting to check your credit report regularly is like ignoring your garden - weeds can grow unnoticed. Your credit report is a detailed summary of your credit history, and monitoring it is essential because it can affect your ability to obtain credit, rent an apartment, and even get a job 5.

Regularly checking your credit report allows you to catch errors or inaccuracies promptly 6. It's like doing a regular inspection of your garden to spot any issues early. A minor error, such as a misspelled name or an incorrect address, may seem inconsequential, but it could have adverse effects on obtaining credit 6.

Moreover, monitoring your credit report can help you detect potential identity theft early. It's like having a fence around your garden to keep out unwanted pests. If you spot any suspicious activity, you can take action quickly to prevent further damage 5. Remember, you can get a free credit report from each of the three major credit bureaus once a year by visiting AnnualCreditReport.com 5. It's like getting a free garden inspection - take advantage of it!

By avoiding these common mistakes, you'll be well on your way to cultivating a healthy credit score. Just like a well-tended garden, your credit will flourish with consistent care and attention.

What Should I Do To Keep Good Credit?

x.com

Building good credit is like tending a garden - it requires patience, consistent care, and long-term planning. Let's explore some habits that will help your credit flourish over time.

5.1. Gradually Increase Your Credit Limits

Think of your credit limit as the size of your garden plot. A larger plot gives you more room to grow, just as a higher credit limit can improve your credit utilization ratio. This ratio is like the density of plants in your garden - you want enough space for everything to thrive.

Requesting a credit limit increase can be a smart move, but timing is key. It's like expanding your garden only after you've proven you can manage what you already have. Wait until you have a stable payment history before asking for an increase. Most people who ask for a limit increase get one, especially if they have a history of on-time payments 1.

Remember, just because you have more credit available doesn't mean you should use it all. Having access to a higher limit and not maxing it out can positively impact your credit score 1.

5.2. Continue to Build a Positive Credit History

Consistently making on-time payments is the cornerstone of a good credit score. It's like watering your plants regularly - skip it, and your garden will wither. Payment history accounts for the largest share of your FICO® Score, so set up automatic payments to ensure you never miss a due date 2.

Using your credit cards for regular purchases and paying them off immediately is a great strategy. It's like giving your credit garden a little boost of fertilizer regularly. This habit keeps your accounts active and demonstrates responsible credit use 3.

5.3. Understand How Major Life Events Impact Credit

Your credit score can affect various aspects of your life, much like how the health of your garden impacts your entire yard. Here's how credit plays a role in major life events:

Renting an Apartment: Many landlords check credit scores as part of the application process. A good credit score can make you a more attractive tenant, like having a lush garden makes your property more appealing 4.

Buying a Car: When it comes to auto loans, your credit score can significantly impact the interest rate you're offered. A higher credit score can lead to lower interest rates, potentially saving you thousands over the life of the loan 4.

Getting a Mortgage: Your credit score plays a crucial role in securing a mortgage. A higher score can lead to better loan terms, including lower interest rates. It's like having a well-established garden that produces abundant fruit - lenders see you as a lower risk 4.

Employment Background Checks: Some employers check credit reports as part of their hiring process, especially for positions that involve financial responsibilities. A good credit history can be seen as a sign of reliability and responsibility 4.

Remember, building and maintaining good credit is an ongoing process. It's not about quick fixes but about cultivating good habits over time. By consistently practicing these habits, you'll be well on your way to a healthy financial future. Just like a well-tended garden, your credit will flourish with regular care and attention.

Improving Your Credit Score

thebalancemoney.com

Once you've mastered the basics of credit building, it's time to level up your game. Think of these advanced strategies as power-ups in a video game - they can boost your credit score faster and unlock additional financial benefits.

7.1. Credit Card Upgrades and Rewards Cards

As your credit improves, you can transition from a secured credit card to an unsecured one. This is like graduating from training wheels to a regular bike. Many credit card issuers will automatically review your account for an upgrade after 6-12 months of responsible use 1.

Once you've established good credit, typically a FICO score of 670 or higher, you can apply for rewards or cash-back credit cards. These cards are like treasure chests in your financial journey, offering perks for your everyday spending. For example, some cards offer 2% cash back on all purchases, while others might give you 3% back on groceries or gas 2.

When using travel, points, or cash-back cards, remember the golden rule: only charge what you can afford to pay off each month. It's like playing a game - the rewards are great, but you don't want to lose by racking up debt.

7.2. Using Rent and Utility Payments to Build Credit

Your rent and utility payments can be secret weapons in your credit-building arsenal. Services like Experian Boost allow you to add your on-time utility and streaming service payments to your Experian credit report, potentially giving your score an instant boost 3.

For rent payments, services like RentTrack can report your payments to all three major credit bureaus. It's like getting extra credit for something you're already doing. Just make sure your landlord or the service you're using is actually reporting your positive payment history 4.

7.3. Negotiating with Credit Card Companies

Once you've established a good credit history, you can start negotiating with your credit card companies. It's like leveling up in a game and unlocking new dialogue options. You can request better interest rates, especially if you've been making on-time payments for a while 5. Don't be afraid to ask for fee waivers or better terms. For example, if you've been hit with a late fee but have an otherwise stellar payment history, call your issuer and ask if they can waive it. Many are willing to do this for good customers 6.

7.4. Leveraging Credit for Financial Benefits

Using credit responsibly can unlock a treasure trove of benefits. Many credit cards offer travel perks like free checked bags or airport lounge access. Some provide extended warranties on purchases or travel insurance 7. Understanding and maximizing credit card rewards without overspending is key.

It's like playing a strategy game - you want to maximize your points without depleting your resources. For example, you might use one card for groceries that gives 3% back, another for travel that offers miles, and a third for everything else that gives 2% cash back 8.

Remember, these advanced strategies are optional and best used once you've mastered the basics of credit building. They're like advanced game modes - exciting and potentially rewarding, but they require careful management to avoid pitfalls. Always prioritize paying your balance in full and on time over chasing rewards 9.

By implementing these strategies wisely, you can accelerate your credit growth and unlock additional financial benefits. It's like unlocking all the achievements in your financial game - satisfying and potentially very rewarding!

How To Fix Mistakes In Your Credit

Scott Graham - unsplash.com

Oops! We all make mistakes, especially when we're just starting out on our credit journey. But don't worry, even if you've stumbled, you can get back on track. Let's explore how to recover from some common credit missteps.

8.1. How to Handle Missed or Late Payments

If you've missed a payment, don't panic! Act fast, like a firefighter rushing to put out a small flame before it becomes a blaze. Contact your creditor immediately. Many lenders are willing to work with you, especially if it's your first late payment 1. You might be able to negotiate having the late payment removed from your credit report if you can pay the balance quickly.

To prevent future slip-ups, set up reminders on your phone or calendar. Better yet, enroll in automatic payments. It's like having a responsible robot assistant who never forgets to pay your bills 2.

Just make sure you always have enough funds in your account to cover the payments.

8.2. Reducing Credit Utilization Quickly

High credit utilization is like overstuffing your suitcase - it puts strain on your credit score. To quickly reduce it, try making multiple payments throughout your billing cycle 3. This keeps your balance low when the credit card company reports to the credit bureaus.

Another strategy is using a balance transfer to consolidate high-utilization credit cards 4. It's like pouring water from several small glasses into one big pitcher. Just be careful - balance transfers often come with fees, so read the fine print carefully.

8.3. Dealing with Collections and Charge-Offs

Collections and charge-offs are like big, ugly weeds in your credit garden. They can significantly damage your credit score and stay on your report for up to seven years 5.

When dealing with debt collectors, knowledge is power. Understand your rights under the Fair Debt Collection Practices Act. You can request debt validation to ensure the debt is legitimate and accurate.

In some cases, you might be able to negotiate a "pay for delete" agreement, where the collection agency agrees to remove the negative mark from your credit report in exchange for payment 5. However, be aware that not all agencies will agree to this, and it's becoming less common.

If you're feeling overwhelmed by debt, don't be afraid to seek help. Credit counseling agencies can provide guidance and may be able to help you set up a debt management plan 6.

8.4. How to Rebuild Credit After a Mistake

Rebuilding credit after a mistake is like replanting a garden after a storm. It takes time and patience, but it's definitely possible. One effective tool is a secured credit card 5. These cards require a cash deposit that becomes your credit limit, reducing the risk for the issuer and giving you a chance to demonstrate responsible credit use.

Credit-builder loans are another option. They're like training wheels for your credit, helping you build a positive payment history 5.

While you're rebuilding, avoid quick fixes that can lead to more trouble. Payday loans, for example, often come with sky-high interest rates and can trap you in a cycle of debt 7.

Remember, recovering from credit mistakes is a marathon, not a sprint. Be patient with yourself, stick to good credit habits, and over time, your credit score will improve. It's like tending to a garden - with consistent care and attention, even after a setback, your credit can bloom again.

How To Build Credit - FAQs

wikihow.legal

Building credit can feel like navigating a maze, especially for newcomers. Let's address some common questions to help clear the fog: How long does it take to build credit? Think of it like growing a plant. You'll see the first sprouts in about 3-6 months of responsible credit use 1.

But to grow a strong, sturdy credit score (700+), you'll need to nurture it for 1-2 years with consistent good habits 2. Can you build credit without a credit card? Absolutely! It's like taking the scenic route instead of the highway. You can use credit-builder loans, which are like practice runs for your credit. Some services also report rent and utility payments to credit bureaus, turning your everyday bills into credit-building tools 3.

Does checking your own credit hurt your score? No way! It's like looking in a mirror - you can do it as often as you want without any damage. These self-checks are called "soft inquiries" and don't affect your score 4.

What's the difference between a hard and soft inquiry? Think of soft inquiries as window shopping - they don't impact your credit score. This includes checking your own credit or getting pre-qualified for offers. Hard inquiries, on the other hand, are like trying on clothes - they happen when you actually apply for credit and can slightly lower your score 4.

But don't worry too much; a single hard inquiry usually only drops your score by a few points. Remember, building credit is a journey, not a race. Stay patient, keep learning, and you'll be on your way to a healthy credit score in no time!

Credit Building Recap

self.inc

Building credit is like nurturing a delicate plant - it requires patience, care, and consistent attention. As we wrap up our journey through the world of credit, let's review some key points and look at ways to keep your financial garden thriving.

6.1. Key Takeaways

Starting small is the best way to begin your credit journey. Consider getting a secured credit card or becoming an authorized user on someone else's account 1. These are like starter pots for your credit plant, giving it a safe place to grow roots. Paying your bills on time is crucial - it's like giving your credit plant regular water 2.

Set up automatic payments to ensure you never miss a due date. Keep your credit card balances low, aiming to use less than 30% of your available credit 3. This is like pruning your plant to keep it healthy and strong.

Make it a habit to check your credit report regularly, like inspecting your plant for pests 2. You can get free weekly online reports from all three major credit bureaus at AnnualCreditReport.com 4. If you spot any errors, dispute them immediately to keep your credit healthy.

Avoid common credit mistakes that can damage your score. Late payments, maxing out credit cards, and applying for too many accounts at once are like overwatering, overfertilizing, or transplanting your credit plant too often - they can stunt its growth or even kill it 3.

6.2. Encouragement for New Credit Users

Remember, building credit is a marathon, not a sprint. It takes time for your credit plant to grow strong and tall. Be patient and consistent in your efforts. Every on-time payment and responsible credit use is like giving your plant the nutrients it needs to thrive 5.

The good habits you form today will set the foundation for your future financial success. A strong credit score can open doors to better loan terms, lower insurance rates, and even job opportunities 5. It's like having a lush, healthy garden that provides benefits for years to come.

6.3. Additional Resources

To help you on your credit-building journey, take advantage of free credit monitoring services like Credit Karma or Experian 6. These tools can help you track your progress and alert you to any potential issues, like a gardener's almanac for your credit.

Explore financial literacy websites and government resources for more in-depth information. The Consumer Financial Protection Bureau offers a wealth of educational tools on topics like buying a house, paying for college, and managing money 4.

For personalized strategies, consider consulting with a financial advisor. They can provide tailored advice based on your unique financial situation, like a master gardener helping you design the perfect landscape for your yard 7.

Remember, everyone starts somewhere when it comes to credit. With patience, diligence, and the right tools, you can cultivate a strong credit score that will serve you well throughout your financial life. Happy credit building!